Top 16 BNPL Apps in India 2026 | Best Buy Now Pay Later Platforms

Below is a refined, professional, SEO-ready version of your content.

I’ve kept your insights and structure intact, but tightened the language, removed repetition, improved flow, and made the tone authoritative and publication-grade—suitable for a fintech blog, media site, or long-form comparison guide.

Buy Now, Pay Later Apps in India: A Practical Guide (2026)

Visit almost any e-commerce checkout page in India today and you’ll notice a familiar pattern: Buy Now, Pay Later (BNPL) options placed right alongside UPI and card payments. While BNPL isn’t yet as dominant as UPI, it is quietly reshaping how Indians shop and manage short-term credit.

This shift intrigued us. So we tested multiple pay-later services across various price points, use cases, and merchant categories. After evaluating real-world usability, hidden fees, repayment flexibility, and merchant acceptance, we’ve compiled this no-nonsense guide to the best Buy Now, Pay Later apps in India.

Before diving into the list, let’s cover the basics.

What Are Buy Now, Pay Later Apps?

Buy Now, Pay Later apps are digital credit services that allow users to make purchases immediately while deferring payment to a later date.

Typically, these platforms offer:

- A 15–30 day interest-free grace period, or

- The option to convert purchases into monthly EMIs for larger ticket sizes

BNPL apps are designed to be faster and more accessible than traditional credit cards, especially for users with limited or no credit history.

Why Are Buy Now, Pay Later Apps So Popular?

BNPL adoption in India is driven by a mix of convenience, accessibility, and psychology.

1. Credit cards remain hard to get

Despite India’s digital progress, securing a credit card is still challenging for many users due to documentation hurdles or lack of credit history. BNPL apps, on the other hand, often approve users within minutes.

2. Lower psychological friction

A delayed payment feels less intimidating than a credit card bill—even though the costs can add up quickly if not managed carefully.

3. Seamless checkout experience

Once users experience one-tap or OTP-free checkout, going back to manual card entry feels inconvenient.

4. Strong market growth

India’s BNPL market is projected to reach USD 35.07 billion by 2030, growing at a CAGR of 9.8% annually. Adoption is especially strong in tier-2 and tier-3 cities, where traditional credit penetration remains low.

How We Evaluated the Best BNPL Apps

Our rankings are based on a combination of quantitative and qualitative factors:

- Overall user adoption

- App Store and Play Store reviews

- Payment success rate and UX

- Credit limit flexibility

- Merchant acceptance

- Customer support responsiveness

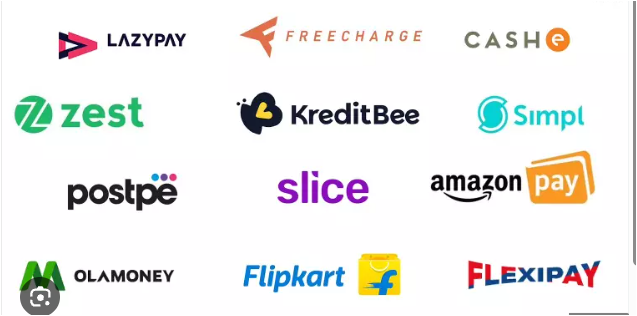

Our Picks: Top Buy Now, Pay Later Apps in India

Below is a detailed breakdown of the most prominent BNPL platforms currently operating (or recently operating) in India.

1. LazyPay

LazyPay, backed by PayU, is one of India’s largest BNPL platforms with acceptance across 45,000+ online merchants, including major e-commerce and food delivery platforms.

Key Features

- Credit limit up to ₹1,00,000

- Personal loans up to ₹5 lakh

- 15-day interest-free period

- No-cost EMI options (3–12 months)

Pros

- Fast checkout with minimal OTP friction

- Strong adoption in tier-2 and tier-3 cities

Cons

- Complaints around aggressive collection practices

- Occasional technical glitches leading to failed payments

2. Simpl

Simpl operates like a digital “khata,” offering one-tap checkout across 26,000+ merchants, including quick-commerce platforms.

Key Features

- Credit limit up to ₹25,000

- Bi-monthly billing cycle

- Pay-in-3 option over 90 days

Pros

- Flexible repayment approach

- Positive feedback for customer empathy

Cons

- Payment settlement delays reported by users

- Occasional transaction mismatches

3. ZestMoney (Discontinued)

ZestMoney was one of India’s earliest BNPL pioneers but shut down operations in late 2023 due to regulatory and business challenges.

Highlights

- Pioneered card-less EMI purchases

- Acquired by DMI Group in 2024

Why It Mattered

ZestMoney played a crucial role in introducing BNPL to first-time online shoppers, especially for electronics and education purchases.

4. Amazon Pay Later

Amazon Pay Later is tightly integrated within the Amazon India ecosystem, offering instant credit at checkout.

Key Features

- EMI tenures from 3–12 months

- ₹60,000 annual cap for minimum KYC users

Pros

- Clean dashboard and seamless Amazon integration

Cons

- Limited usability outside Amazon

- Inconsistent credit limit upgrades

5. Flipkart Pay Later

Flipkart Pay Later consolidates multiple purchases into a single monthly bill across Flipkart and Myntra.

Key Features

- Credit limit up to ₹1 lakh

- Pay within 30 days or convert to EMIs

Pros

- Interest-free repayment within the billing cycle

Cons

- Restricted ecosystem usage

- Sudden credit limit changes reported

6. Paytm Postpaid

Paytm Postpaid integrates BNPL with UPI, making it usable for both online and offline payments.

Key Features

- Credit limit up to ₹60,000

- Interest-free period up to 30 days

Pros

- Wide merchant acceptance

Cons

- Customer support responsiveness issues

- Unexpected account restrictions

7. Freecharge Pay Later (Discontinued)

Previously backed by Axis Bank, Freecharge Pay Later was discontinued in December 2024.

Why Users Liked It

- Simple monthly billing

- No multiple due dates

Why It Fell Short

- Same-day billing and due dates

- Reported impact on credit scores

8. OlaMoney Postpaid

Originally built for ride payments, OlaMoney Postpaid now covers utilities, shopping, and food.

Pros

- Extremely convenient for frequent Ola users

Cons

- Invite-only access

- Limited utility outside Ola’s ecosystem

9. MobiKwik ZIP

MobiKwik ZIP functions like a digital credit card inside the MobiKwik wallet.

Key Features

- Credit limit up to ₹60,000

- One-time activation fee

Pros

- Useful for short-term cash flow gaps

Cons

- Customer support delays

10. Tata Neu Credit (NeuPass)

Integrated within Tata Neu’s super-app ecosystem.

Pros

- Strong rewards via NeuCoins

- Best suited for Tata brand loyalists

Cons

- Limited flexibility outside the Tata ecosystem

11. Kissht

Focused on inclusive credit access, Kissht offers EMI-based financing.

Pros

- Easy approvals

- Wide offline store coverage

Cons

- Collection practice complaints

- Occasional disbursement delays

12. axio (formerly Capital Float)

Axio partners with major platforms like Amazon and Razorpay.

Pros

- Strong reach in non-metro cities

- No prepayment penalties

Cons

- Poor customer service reviews

13. ePayLater

Primarily built for small businesses and kirana stores.

Pros

- High credit limits (up to ₹25 lakhs)

- No hidden charges

Cons

- Inconsistent approvals

- Slow support responses

14. FlexPay by Vivifi

One of the few BNPL apps offering UPI-based credit.

Pros

- Works at almost any UPI merchant

- Flexible repayment

Cons

- Interest can accumulate quickly

- App stability issues

15. Freo Pay

A minimalist BNPL app targeting small, everyday expenses.

Pros

- Zero interest for 30 days

- Fast approvals

Cons

- Low initial credit limits

- High late payment penalties

16. Slice

Originally positioned as a credit card alternative for young users.

Pros

- Transparent fee structure

- Modern, intuitive app design

Cons

- Mixed customer support experiences

Final Thoughts: BNPL Is a Tool, Not Free Money

Buy Now, Pay Later apps have undeniably changed how India spends. They make payments frictionless—but that ease can encourage overspending.

A simple rule applies: if you can’t comfortably repay it within two paychecks, reconsider the purchase.

BNPL services are powerful financial tools. Used wisely, they offer flexibility. Used carelessly, they can quietly damage your financial health.

As always, spend smart—and remember, convenience should never replace discipline.

Leave a Reply